In the interesting theatre of the Nigerian Stock Exchange (NGX), “profit” is often a matter of opinion, but dividends are a matter of fact. For the Nigerian investor, watching a portfolio turn green on your preferred trading platform (Bamboo for us) offers a dopamine hit, but until you sell, that wealth is pretty much a theory. In an economy defined by relentless double-digit inflation and unpredictable currency volatility, the only return that truly counts—the only metric that cannot be restated or revalued away—is the cold, hard cash that hits your bank account.

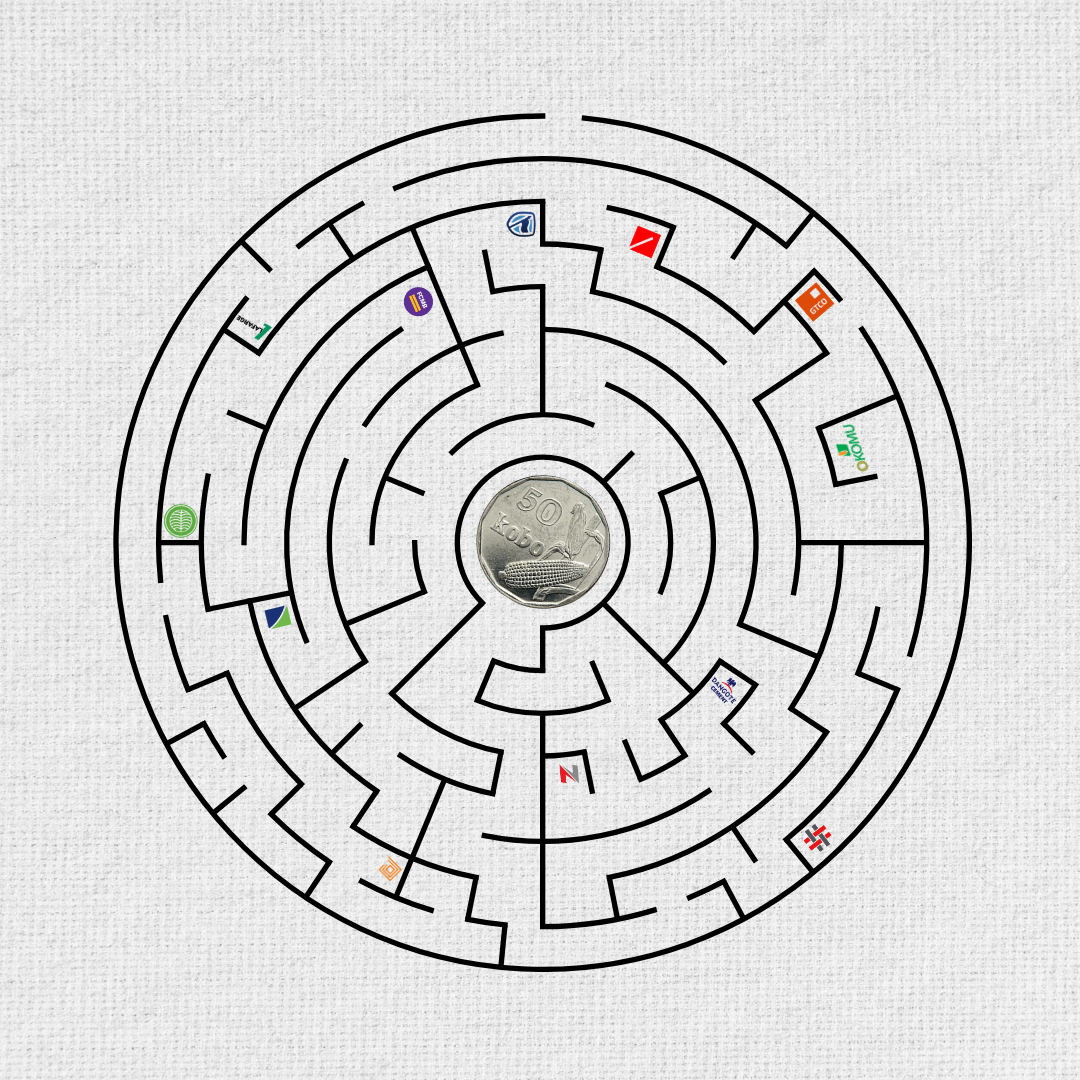

Navigating this reality requires more than just picking Twitter-famous names or chasing the highest reported earnings. It requires understanding the invisible machinery of how dividends are created, why they fail, and how to spot the difference between a cash cow that feeds you and a value trap that starves you.

The Mirage and the Machine

To the uninitiated, a dividend is simply a share of the profit given back to owners. But in Nigeria, under the strict rules of the Companies and Allied Matters Act (CAMA) 2020, the path from revenue to shareholder payout is a regulatory minefield.

Under CAMA 2020, a company can only pay dividends out of distributable profits: realised profits minus realised losses and previous distributions. When accumulated losses wipe out retained earnings, the company is effectively locked out of paying dividends until it rebuilds positive reserves.

What a Dividend Really Is

A dividend is a friendly credit alert from the company you have chosen to contribute to from your pockets. It is a cash distribution from distributable profit, approved by the board (and usually shareholders) and paid out of retained earnings.

Formula-wise, it’s simple:

- Dividend per Share (DPS) = Total dividend ÷ Shares outstanding

- Dividend Yield = DPS ÷ Share Price

- Payout Ratio = DPS ÷ Earnings per Share (EPS)

On the NGX, dividends are plain cash. The moment it hits your bank account, you either ball or double down on the stock that delivered.

From Revenue to Dividend

Two companies can report the same Profit After Tax and have very different dividend capacities. The one with positive retained earnings, real operating cash flow, and manageable debt can pay you. The one with negative reserves or FX holes cannot – CAMA won’t allow it. Dividends are calculated from this residual, not from whatever the earnings slide looks like in the investor deck.

However, profit on paper does not equal cash in hand. This is where the financial engineering begins—and where the story of MTN Nigeria serves as a brutal lesson in macroeconomics.

For years, MTN was the undisputed “dividend machine” of the NGX, reliably turning airtime and data sales into payouts that grew steadily from ₦8.47 in 2020 to ₦15.60 in 2023. Investors treated it like a bond. But in 2024, the machine stopped. The tragedy wasn’t operational—Nigerians were still buying data at record rates. The tragedy was structural.

When the Naira was floated, MTN’s massive dollar-denominated obligations (tower leases and letters of credit) exploded in value as the rate moved from ₦800/$ to ₦1,600/$. The naira float turned MTN’s FX exposure into a black hole, with FX losses running into hundreds of billions and flipping retained earnings into a deep deficit.

This loss didn’t just wipe out current profits; it destroyed the company’s Retained Earnings—the reservoir of past profits kept for rainy days. Even if MTN had cash in the bank from selling data today, CAMA 2020 essentially froze their ability to distribute it until their accumulated losses were cleared. The “Dividend Machine” wasn’t broken by the market; it was broken by the balance sheet. Although a cautious ₦5.00 interim dividend appeared in late 2025, the lesson remains indelible: FX nuked equity, not operations.

What a Healthy Dividend Looks Like in Nigeria

In a sane world, a mature Nigerian company paying dividends should sit roughly in this zone:

- Payout Ratio: 30–60% of earnings

- Coverage: EPS at least 1.5–2× DPS

- Yield: High enough to compensate for inflation, but not so high it screams distress

Anything above 80% payout is desperation. Anything below 10% for a mature, cash-rich business is stinginess or misallocation. These mature companies are typically found on the NGX30 list.

The Inflation Hedge

If MTN represents the fragility of import-dependent giants, Presco Plc illustrates the raw, compounding power of the “Yield on Cost.”

While banks and telcos scrambled to engineer their books against FX losses—often having to strip out “unrealised FX gains” before the Central Bank would allow a payout—Presco thrived on the very thing killing the average consumer: inflation. Presco produces palm oil, a staple commodity priced in Naira but linked to global dollar prices. As the cost of food soared, so did Presco’s cash flow, without the heavy burden of dollar debts dragging it down.

In 2025, Presco’s share price went parabolic, hitting ~₦1,450. But the real story isn’t for the new buyer. For investors who got in when Presco traded in the double-digit naira range a decade ago, the 2025 interim dividends alone now equal or exceed their original entry price. That’s 100%+ yield on cost in one year.

This is the holy grail of Nigerian investing: finding a company whose product is inflation-proof (pass-through costs) and whose payout eventually exceeds your original entry price. It transforms a stock holding into a perpetual annuity that inflation cannot erode.

The Story Stock Trap

However, a rising tide does not lift all boats. Investors often look at Presco’s success and blindly buy into other agricultural narratives, leading them straight into traps like Ellah Lakes.

On paper, Ellah Lakes is in the same hot sector: Agriculture. In reality, it is a “Story Stock.” While Presco has a mature, cash-printing plantation model with decades of harvest cycles, Ellah Lakes has spent years in developmental phases, restructuring, and capital raising. The critical difference? The receipt.

For all the noise around agriculture, Ellah Lakes’ dividend history is a flat line: zero. This contrast highlights the danger of speculation. An investor buying the “story” of agriculture without the “receipt” of dividends is left holding “dead money.” In a high-inflation environment like Nigeria’s, a stock that pays nothing is costing you 30% a year in purchasing power. If a company has not paid a dividend in five years, the market is telling you it is either structurally unprofitable or stuck in a capital-intensive loop that may never end.

The Strategy for 2026

So, how do you navigate this maze in 2026? You need a mercenary strategy backed by data.

1. Calculate Real Yield (The “Silent Tax” Test)

Don’t just look at the percentage; look at your purchasing power. Use the formula:

DPS / EPS X 100.

If inflation is hovering near 15% and your yield is 2%, your “income stock” is just a slow-motion loss unless the price is exploding upwards. You need a buffer.

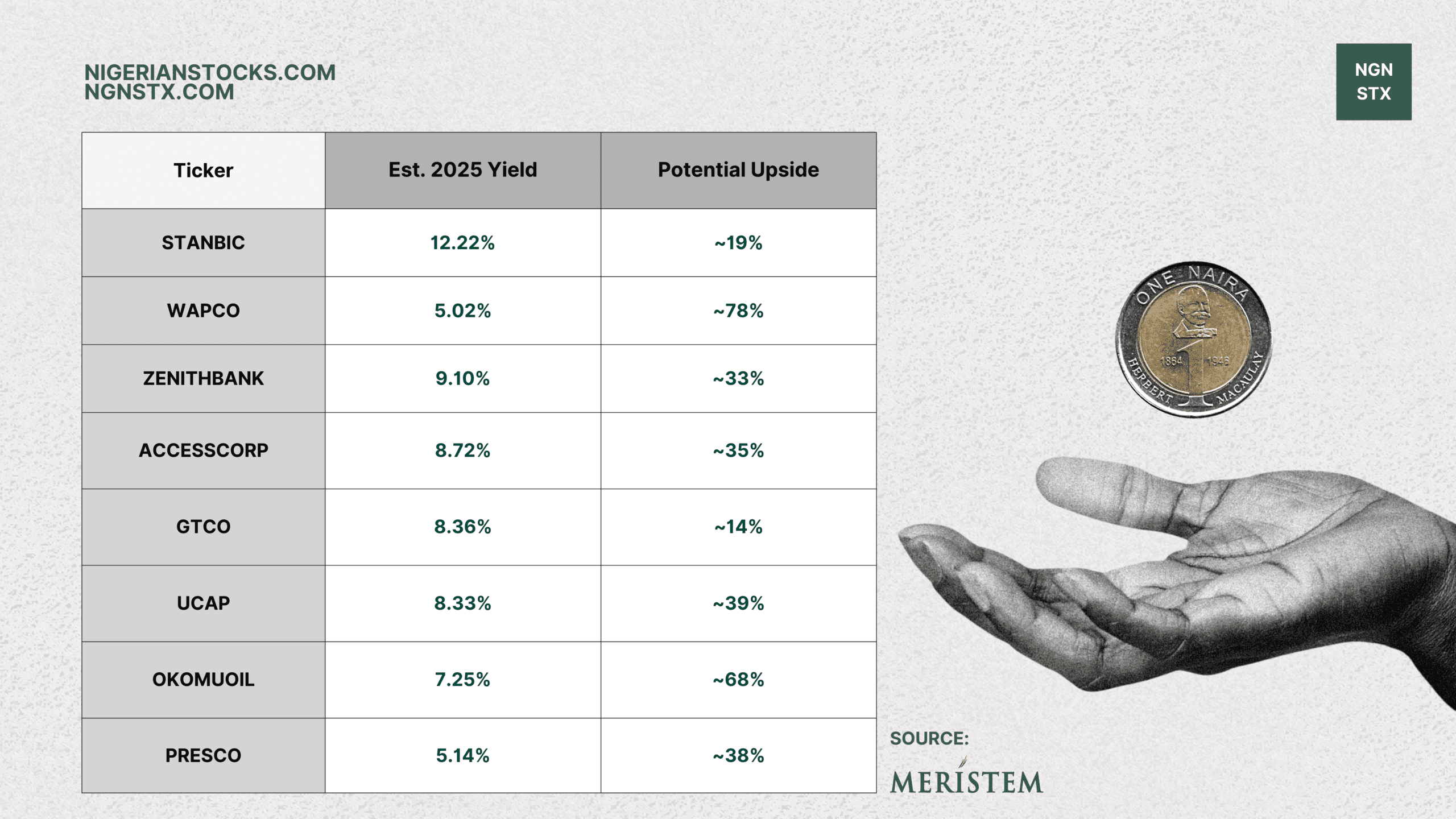

- The 2026 Evidence: Look at Stanbic IBTC. Data for the 2025FY (payable in 2026) projects a yield of 12.22%. While this doesn’t beat inflation alone, it provides a decent cash cushion that “story stocks” (paying 0%) cannot match.

2. Target the “Double Threat” (Yield + Upside)

A high dividend is useless if the share price crashes. You need stocks that pay you while they grow.

Based on 2025FY estimates, we can identify a specific “Class of 2026” that fits this criteria: consistent payers with >5% yield and >10% price upside.

- WAPCO (Lafarge): The standout for 2026. While the yield is modest (~5%), the potential price upside is projected at ~78%. This is how you beat the “Silent Tax”—the dividend pays the rent; the capital gain builds the wealth.

- Zenith Bank: A reliable compounder projecting a 9.1% yield with ~33% upside.

- Okomu Oil: An inflation hedge. As food prices rise, their revenue rises. They offer a 7.25% yield with a massive ~68% upside potential.

3. Target the Date (The January–June Window)

The exchange does not reward loyalty. It rewards timing. Own the stock on the Qualification Date, collect, and rotate. Your broker statement does not care if you “believe in the brand.”

- The Play: Most of these consistent payers (AccessCorp, GTCO, UCAP) release earnings early in the year. The strategy is to position between January and April to capture the run-up, and then decide: do you take the cash on the Qualification Date, or sell the news?

4. Watch the Payout Ratio

You want a company paying out 30-60% of its earnings.

- > 80%: The company is bleeding cash to keep shareholders happy and won’t have enough to grow or survive a shock.

- < 10%: The management is stingy or hoarding cash for projects that may never materialise.

That being said…

There are a few legitimate non-payers building long-term infrastructure or tech, but they are the exception, not the rule. Also, note that prices usually adjust down on the ex-dividend date. You’re not getting “free money.” You’re harvesting cash now and accepting price math that may or may not normalise.

If you’re a Nigerian earning, spending, and saving in Naira, your first job is not to “beat the market.” It’s to stop inflation from quietly robbing you. A dividend-aware strategy doesn’t guarantee riches, but it does one crucial thing: it forces you to only trust companies that convert story into cash.

Marketing Manager full time, finance enthusiast off the clock.